Getting started with FinBodhi

Personal finance is about taking control of your finances. And the first step towards it is tracking the flow of money. By flow we mean, value moving between you and some company or person (including yourself). In finance people/companies are represented by accounts. And flow of money is recorded as transactions. So, at its core, tracking flow of money involves transactions between accounts. With all flow of money tracked, understanding and planning your financial journey becomes much simpler. This guide will get you started with creating accounts, recording transactions in FinBodhi.

FinBodhi is a personal finance app based on double-entry bookkeeping. Double-entry allows you to accurately track the flow of money.

To get started, we first need accounts to transact between.

Step 1: Getting started with Accounts

Let’s say you’re a coffee lover who goes to cafe named CuTokai Coffee. In the real world, when you buy coffee, money moves from your bank to the merchant’s bank (let's ignore cards etc for now). In FinBodhi, you replicate this by creating:

- An Asset account to represent your bank

- An Expense account to represent the coffee shop

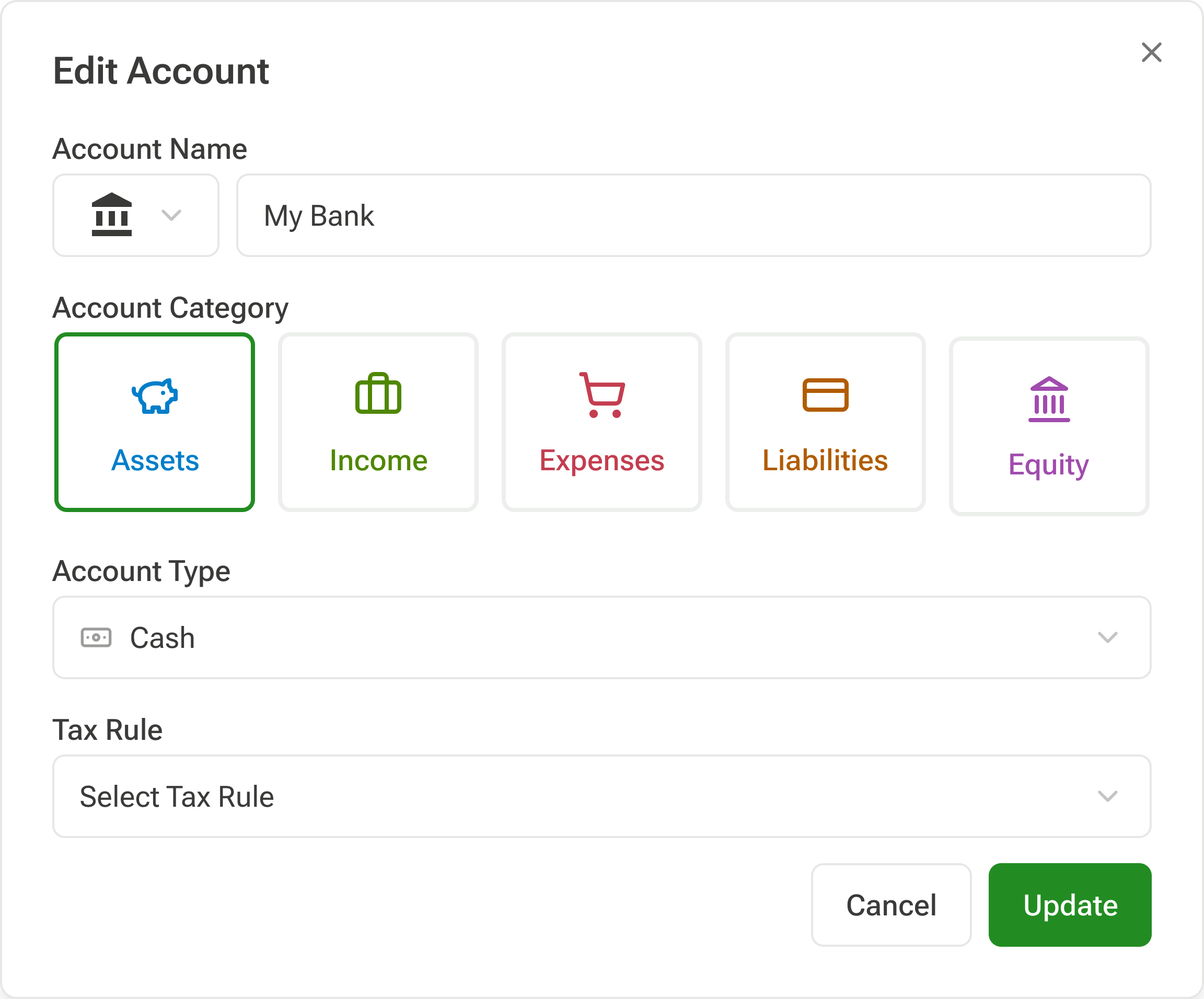

Go to the Accounts Page → click Add New. Start with your bank account:

- Name it anything like “My Bank” or the actual bank name.

- Set the category to Asset

- (optional) add icon

Leave the rest unchanged and create account.

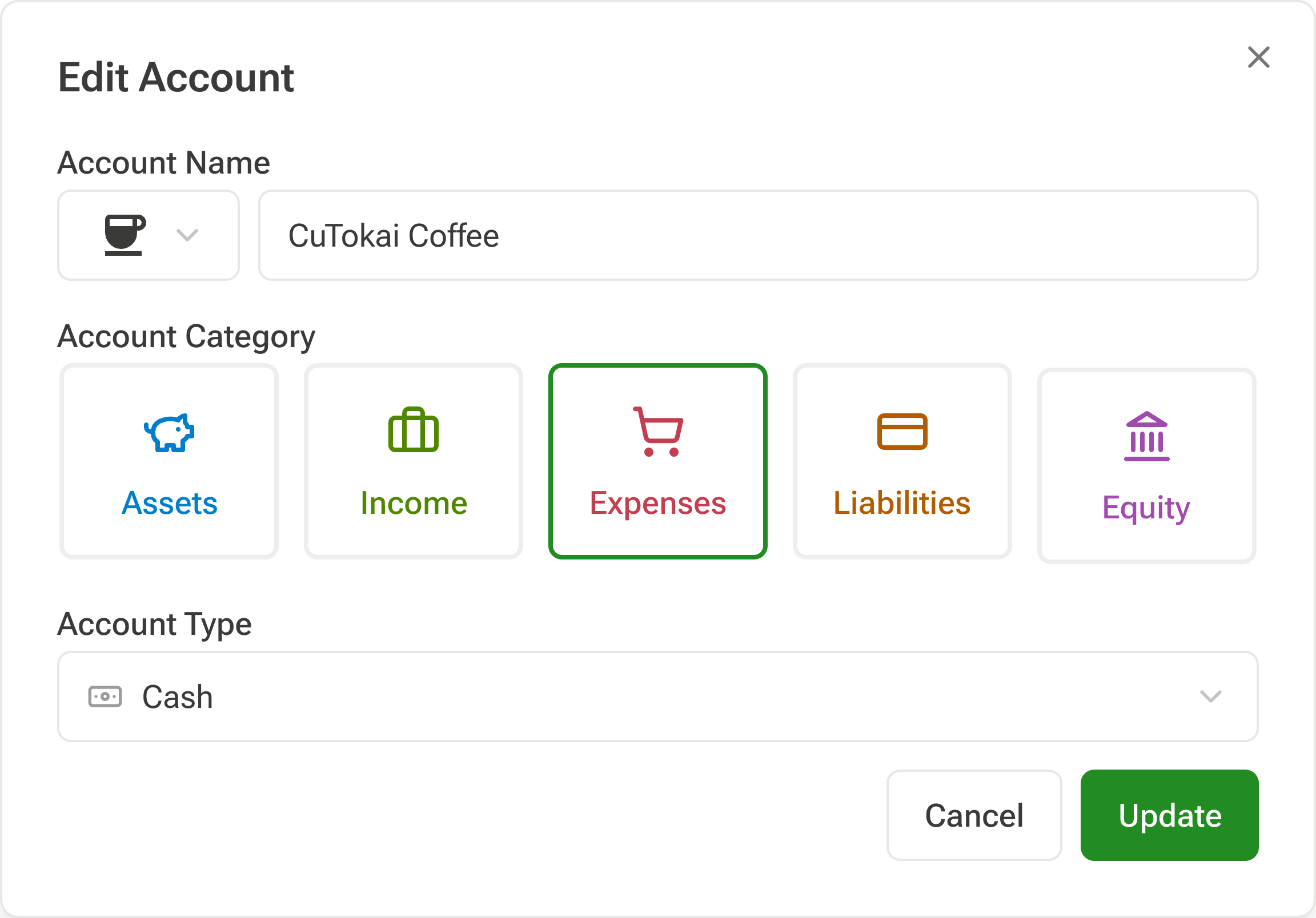

Repeat for the coffee shop:

- Name it CuTokai Coffee

- Set category to Expense

- (optional) add icon

Leave the rest unchanged and create account.

Why Asset and Expense?

You are tracking transactions to answer some questions about value. How much did you make. How much did you spend. How much did you save. What do you owe. Etc. Finance as a field has converged to five different account categories, which let's you answer these kind of questions and much more. This is explained in more detail here. Asset accounts are where you keep your money. Expense accounts are where you spend your money. Here is a list of all the account categories.

Account Categories

- Asset – what you own (e.g., bank, cash, investments)

- Expense – where you spend (e.g., coffee, rent)

- Income – where you earn (e.g., salary)

- Liability – what you owe (e.g., loans, credit cards)

- Equity – used for balancing accounts (ignore for now)

We explore these in more detail in the Understanding Double-Entry guide.

With our two accounts ready, we can now log the actual movement of money by creating a transaction.

Step 2: Add Your First Transaction

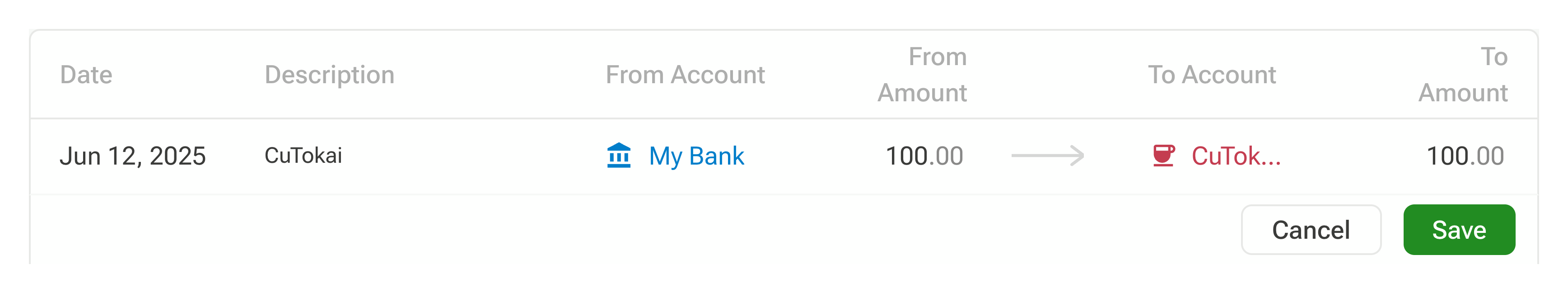

Go to the Transactions page → click Add New:

- Select your bank account in From Account

- Enter the money you paid for coffee

- Select CuTokai account in To Account

- The date defaults to today (change it if you want)

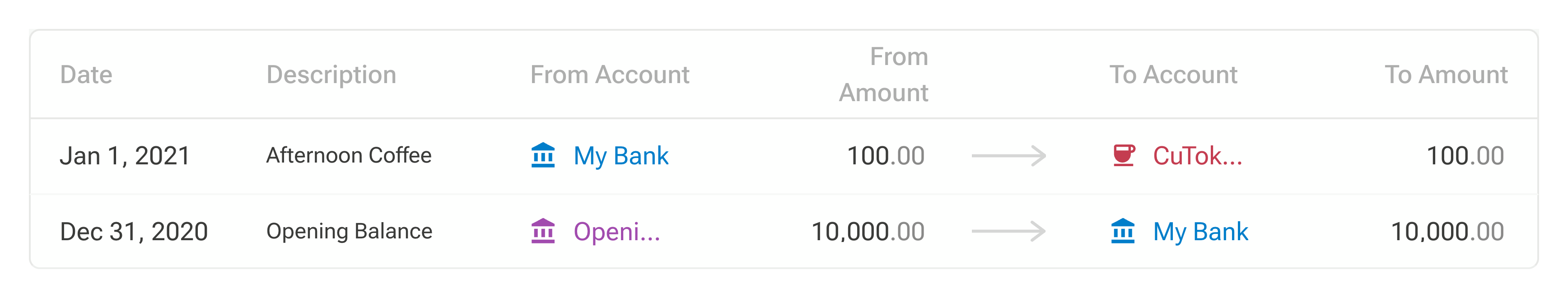

That’s your first transaction.

Enter Double-Entry

This transaction removes money from your bank account and adds money to CuTokai's account. You basically did double-entry accounting.

If this is your first transaction, your bank account balance would be -ve now (it was 0 before). But in reality your bank is unlikely to have -ve balance. This is happening because you don't have all the transactions related to your bank, in FinBodhi.

Equity account

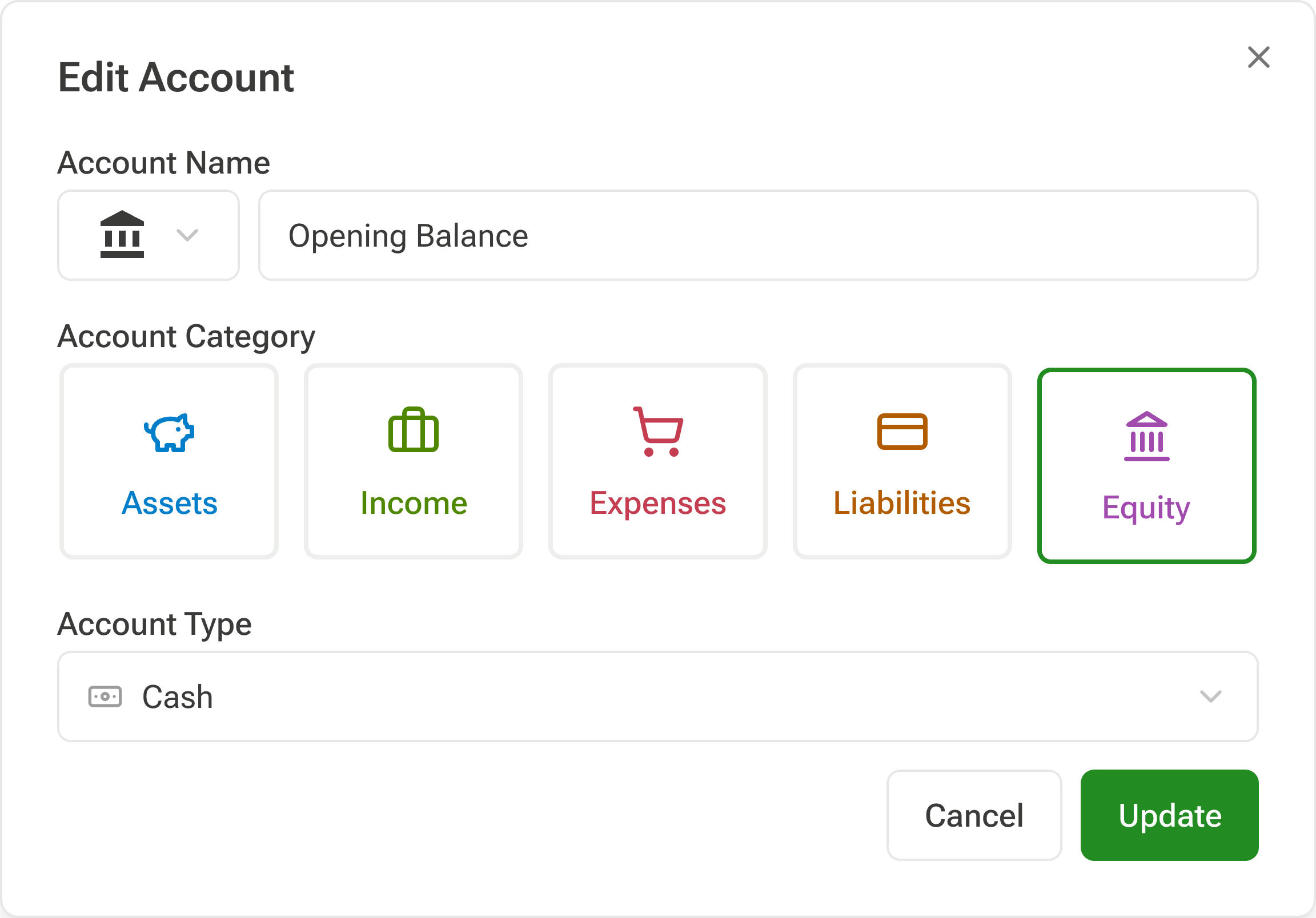

You can import all your transactions. But a quick hack is to do another transaction to fix your bank balance. First we have to create an equity account from where the balance will come. Let's call it Balance Adjustment Account.

Now make a transaction from Balance Adjustment Account to Bank account. Select a date before the coffee transaction date.

Now your balance would show up correctly, and if you continue to keep track of all the future bank transactions in FinBodhi, it will track your bank balance.

In other words, money didn't just appear. It was moved from an equity account. In personal finance, you don't care about equity accounts. They are just a way of making adjustment. Use equity for accounts that you don't want to track.

Income and Liability accounts

Let's quickly cover the two account categories we haven't seen yet.

Income is where you get your money from. As a salaried employee, this would be the salary you get. You can have the company name as account name, or just Salary. Unlike equity account, you care about salary, to answer questions like how much you spend versus how much you make. Or how your income has been increasing over time.

And now, liability accounts. These are loans you took. Money you owe to individual/enterprise.

Commodity type

We looked at how cash moves between accounts. Sometimes you are not dealing with cash both commodities (gold, silver, mutual fund, stocks, car, house). Commodities are valued in terms of cash. Their value can change with time

Now that we have covered the account categories, let's also briefly look at account type. Till now, we have used cash as account type. Other options for account type include commodities like Mutual Fund, Stock, Metal etc. The different is, commodities are valued with cash, and their value could change with time.

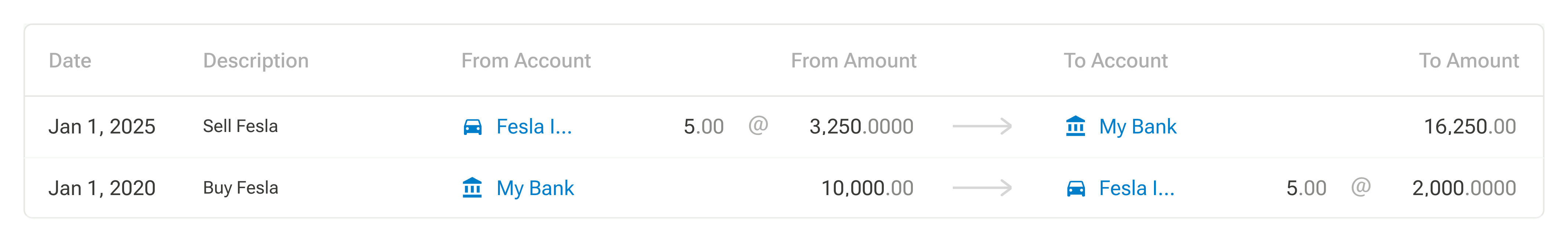

Let's look at a made up example to get better understanding. You bought 5 stocks of a company Fesla Inc., 5 years back, which was value at 2000$ per stock. And when you check today, the price is at 3250$ per stock. The money you paid was the value of Fesla Inc. 5 years back. You would also want to track the current value of the company. When you sell Fesla, you want to be able to evaluate your investment decision. Commodity-based accounts help you track these kind of accounts. We support a few commodities like mutual funds, stocks, NPS, and few metals. And by that we mean, we can get the price for them. But when you capture transactions for these, you still have to mention the buying prices and quantity.

If you want to track some other kind of commodity, you can still do that. The price can be tracked based on transactions (i.e buy and sell prices).

Personal finance accounts vs reality

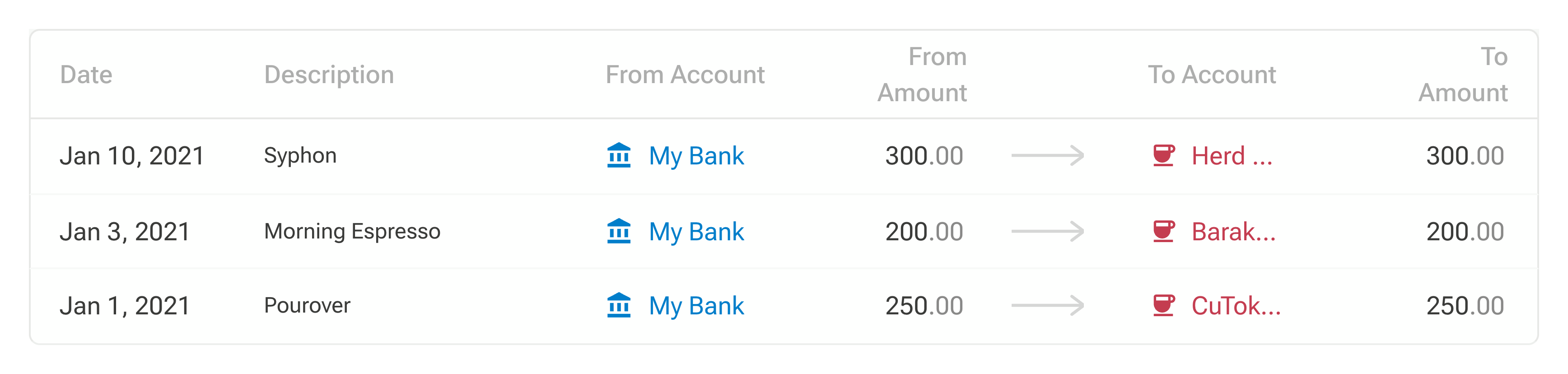

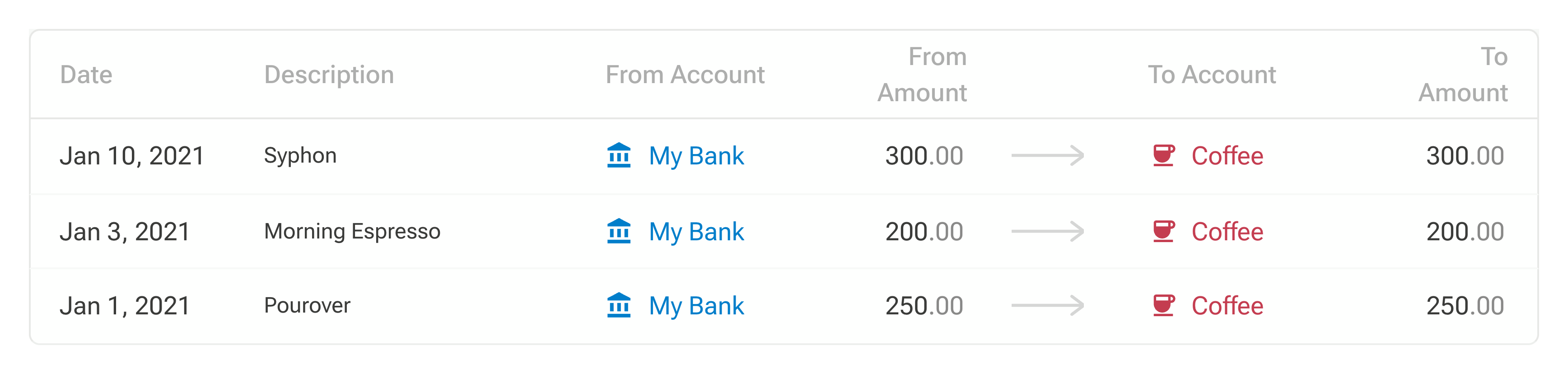

Let's say that you visit more than one coffee shop. CuTokai, Baraku, Herd Wave. Do you create account for each one of them?

The answer depends on what you want to achieve. If you care about spending in each of the coffee shops, then yes. But if you only care about coffee expenditure in general, then you can have just a single account for all of them. Let's say Coffee. You can always use the description field, in case you want to identify a specific transaction.

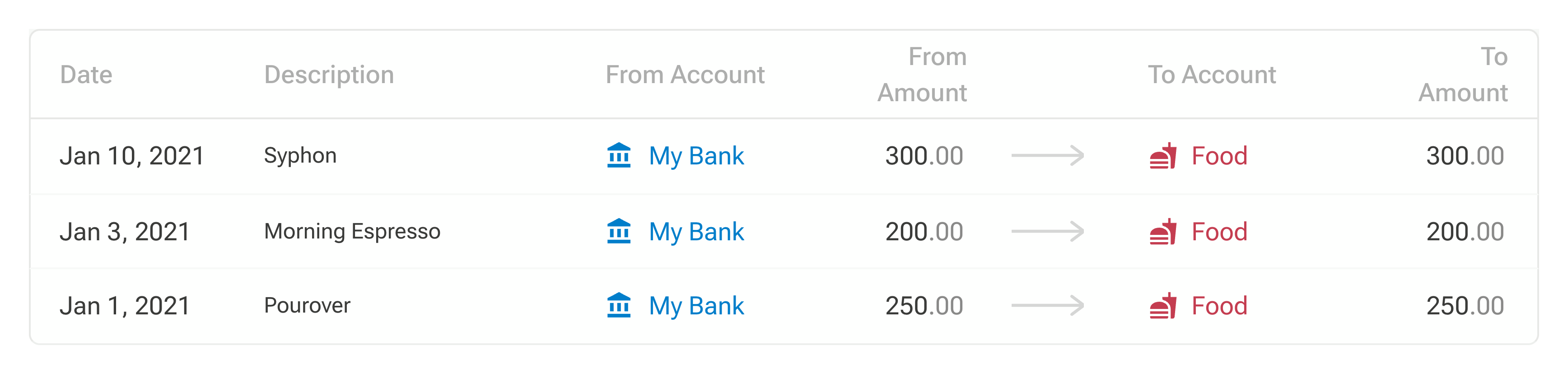

And if you don't care about coffee specifically, but food expenses, then you can have those transactions between Bank account and Food account, where Food is again an expense account.

To recap, create accounts based on what you want to track. And remember, don't be afraid of making mistakes. You can always merge accounts, or create new accounts and move transactions, or rename accounts etc.

Join our newsletter for future updates and posts